japan corporate tax rate 2018

Details of Tax Revenue Japan. PwC Tax Japan Kasumigaseki Bldg.

Global Distribution Of Revenue Loss From Tax Avoidance Re Estimation And Country Results Eutax

Corporate income tax rate 6 6 Year 22 Layout.

. Japan Income Tax Tables in 2020. An under-payment penalty is imposed at 10 to 15 of additional tax due. But if the company is Medium and small sized company the taxable income limitation does not apply.

The tax rates for corporate tax corporate inhabitant tax and enterprise tax on income tax burden on corporate income and per capita levy. The structure of Japans corporate income tax system is broadly in line with those of other G7 countries. Income from 3300001 to 6950000.

25 of corporate tax for the current fiscal year. Product Market Regulation 2018. Income from 1950001 to 3300000.

Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of 334 Table 3-5 applies. The revised plan contained in a draft of the ruling blocs annual tax code revision reviewed by Reuters would further cut the effective corporate tax rate to. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019.

Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence A company that has its principal or main office in Japan is considered to be resident. Tax year beginning after 1 Apr 2018. The 2018 Japan Tax Reforms include the following changes to Japanese individual income tax.

Social Security Rate 3152. Income from 6950001 to 9000000. 50 of taxable income.

The current rate 10 will apply up to gross. The local standard corporate tax rate in Japan is 234 and it applies to normal companies with a share capital which exceeds JPY 100 million USD 896387. Tax year beginning between 1 Apr 201631 Mar 2017.

Corporate Tax Rate 3062. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. Japan Income Tax Tables in 2018.

Income from 0 to 1950000. 55 of taxable income. Effective Statutory Corporate Income Tax Rate.

Tax year beginning between 1 Apr 201731 Mar 2018. Current fiscal year other than subsidiaries of. Paid-in capital of over 100 million.

The rate is increased to 10 to 15 once the tax audit notice is received. Details of Tax Revenue - Latvia. Local management is not required.

Final tax return Corporations are required to file final returns within two months from the last day of their business year. 1 2018 the corporate tax rate was changed from a tiered structure that staggered corporate tax rates based on company income to a flat rate of 21 for all companies. 10 of the increased salary payment plus.

Tax rates for companies with stated capital of more than JPY 100 million are as follows. Regulation in Network and Service Sectors 2018. Details of Tax Revenue Korea.

For a company with capital of 100 million or less a lower rate of 19 is applied to an annual income of 8 million or less. The maximum rate of 147 percent is levied in Tokyo metropolitan. Income from 9000001 to 18000000.

15 of increased salary payment 20 if training costs have increased by 20 or more Limitation on tax credit. 14 14 Taxable Year of Companies. Income from 0 to 1950000.

In addition if RD costs exceed 10 of average revenue either of the following is available. 15 15 Taxable Income. Government at a Glance.

Personal Income Tax Rate 5597. 1 If a company has capital in excess of 100 million Japanese yen or is a wholly owned subsidiary of a large corporation with capital of more than 500 million Japanese yen the company is treated as large corporation under corporate tax. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

However relatively high marginal and average effective tax rates prompt the question of whether adjustments should be considered to meet the objectives of promoting growth investment and competitiveness in a revenue neutral manner. Our company registration advisors in Japan can deliver more details related to the corporate tax in this country. To the rate calculated above.

Above rate x RD costs average revenue - 10 x 05 up to 10 Credit limit. 5 Standard rate 123 percent of the central tax. For a deeper discussion of how this issue might affect your business please contact.

Sales Tax Rate 1000. 15F 2-5 Kasumigaseki 3-chome Chiyoda-ku Tokyo 100-6015. Tax rates The tax rate is 232.

5 rows Corporation tax rate 1 April 2016. Since then the rate peaked at 528 in 1969. The federal corporate income tax was fist implemented in 1909 when the uniform rate was 1 for all business income above 5000.

60 of taxable income. 2 of the salary payment made in the preceding year. Local corporation tax applies at 44 percent on the corporation tax payable.

Local corporation tax applies at 44 on the corporation tax payable. For large corporations the rate is 148 percent of the prefectural enterprise. 6 The special local tax is 81 percent of the prefectural enterprise tax for corporations.

Tax rates for companies with stated capital of JPY 100 million or greater are as follows. In the case that a corporation amends a tax return and tax liabilities voluntarily. Place for tax payment.

Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. Tax Rate applicable to fiscal years beginning between 1 April 2016 and 31 March 2018. Corporation tax is payable at 234.

Business tax comprises of three variables Regular business tax special local corporate tax and size-based business tax. Corporation tax is payable at 239 percent. Up to 10 of the corporate tax liability Up to.

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

Be Cautious About Raising The Corporation Tax Rate Oxford University Centre For Business Taxation

Lithuania Corporate Tax Rate 2021 Data 2022 Forecast 2006 2020 Historical

Real Estate Related Taxes And Fees In Japan

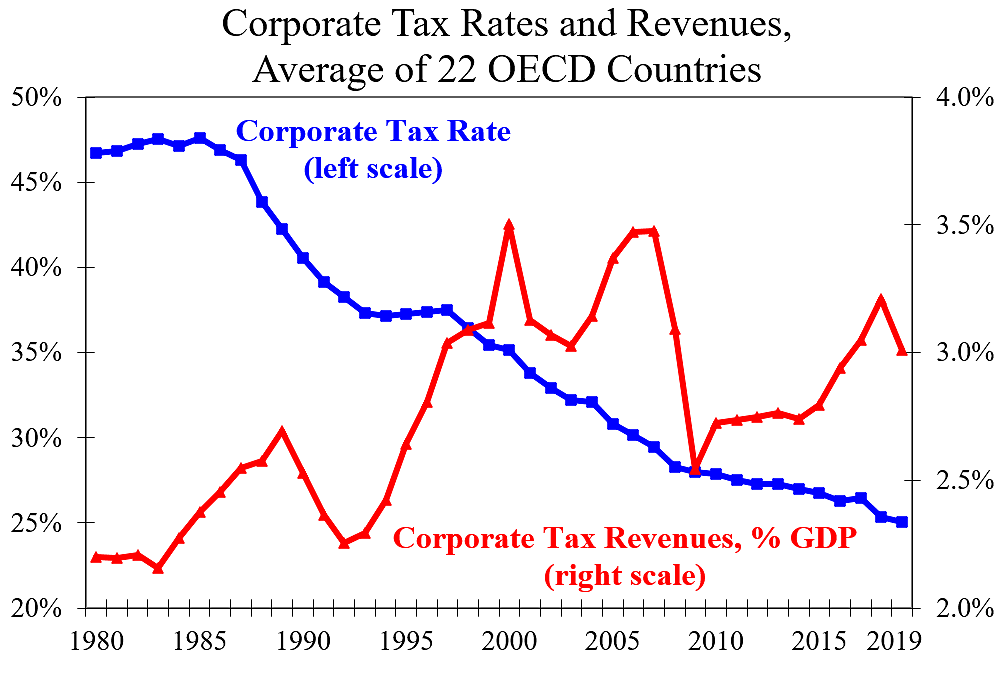

Corporate Tax Remains A Key Revenue Source Despite Falling Rates Worldwide Oecd

Corporate Tax Reform In The Wake Of The Pandemic Itep

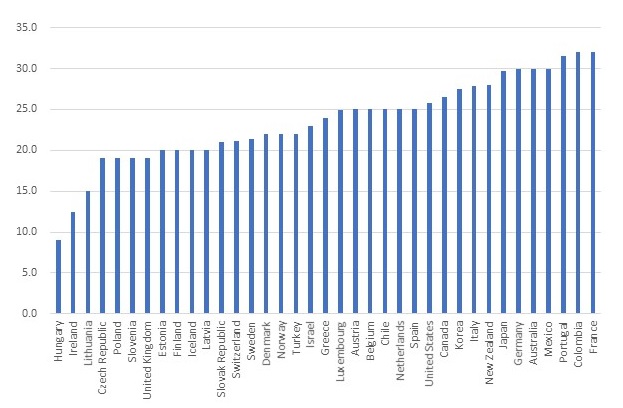

An Overview Of The Taxation Of Residential Property Is It A Good Idea Public Sector Economics

International Taxation And Luxembourg S Economy In Imf Working Papers Volume 2020 Issue 264 2020

Real Estate Related Taxes And Fees In Japan

International Corporate Tax Avoidance A Review Of The Channels Magnitudes And Blind Spots In Imf Working Papers Volume 2018 Issue 168 2018

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Corporate Taxes Rates Down Revenues Up Cato At Liberty Blog

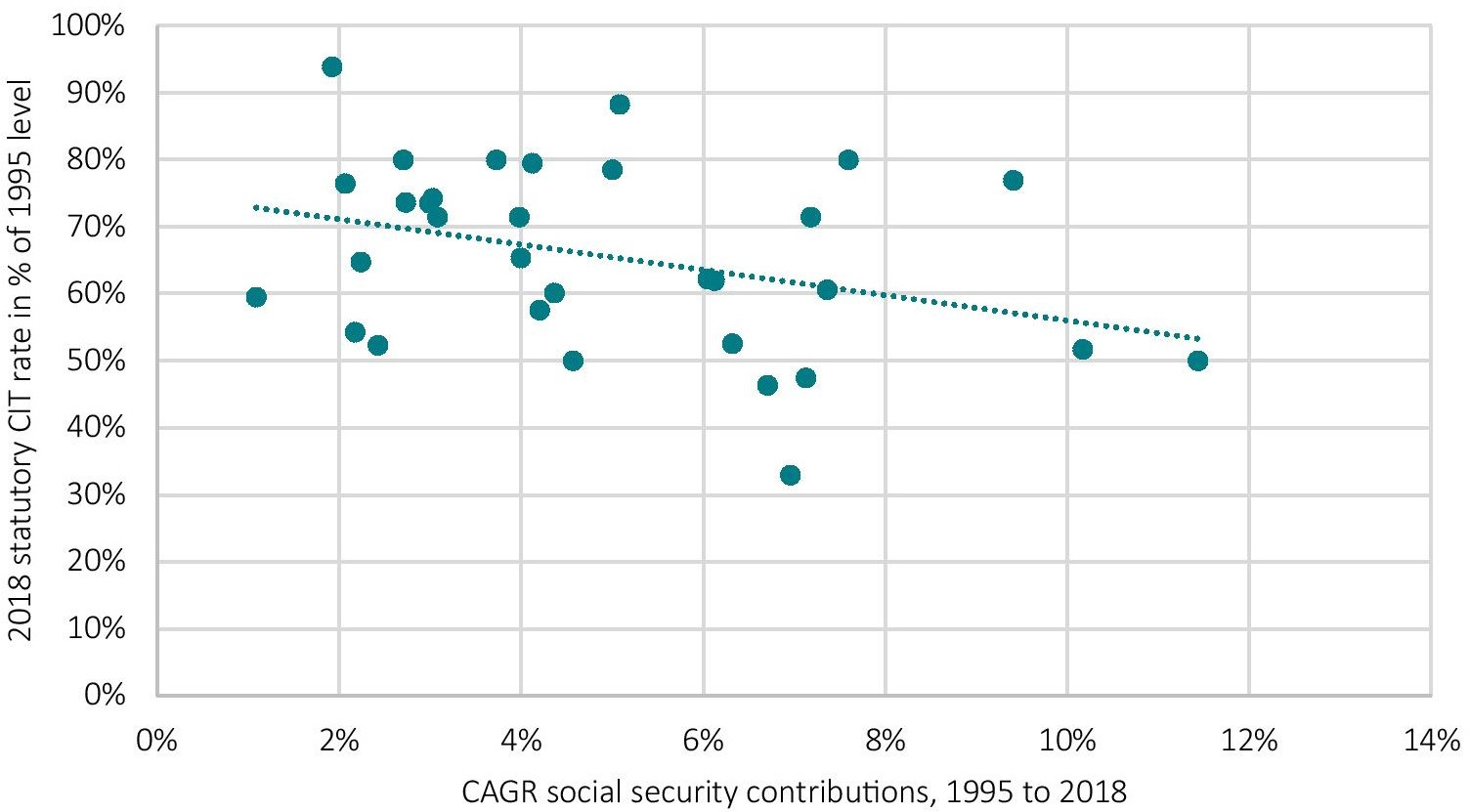

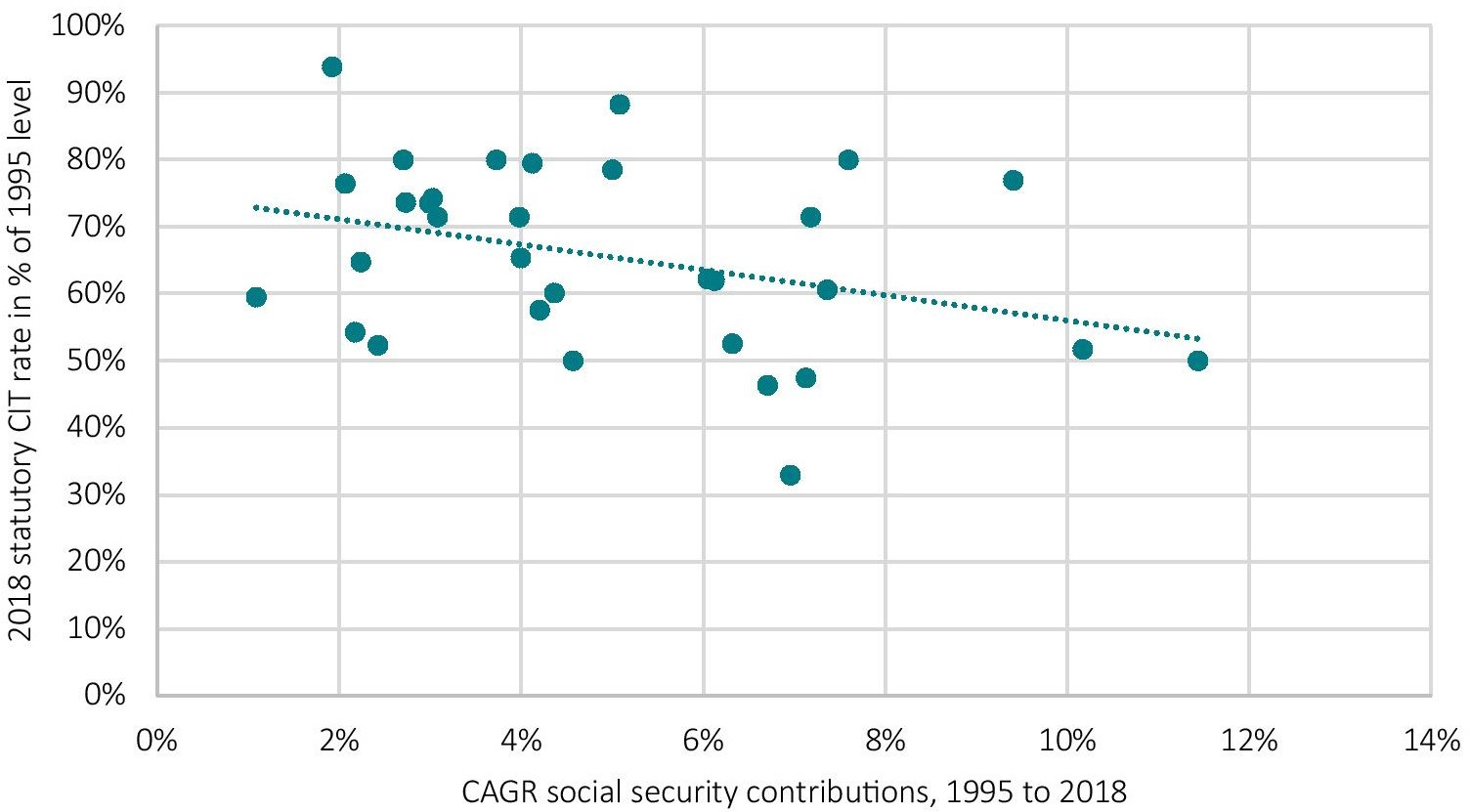

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Corporate Tax Reform In The Wake Of The Pandemic Itep

日本 企业所得税税率 1993 2021 数据 2022 2024 预测

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

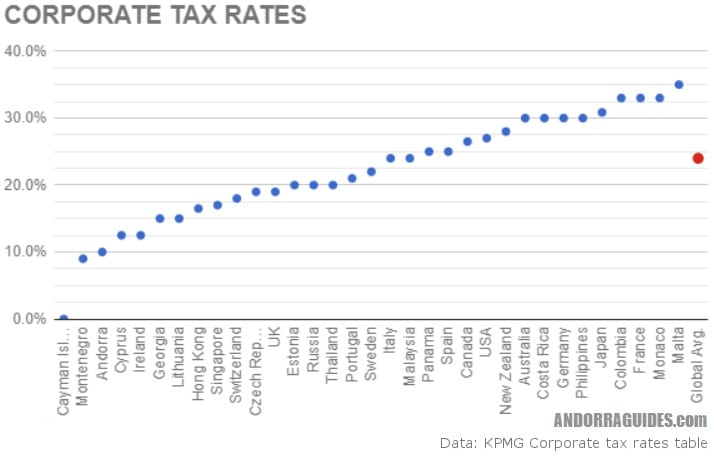

The Andorra Tax System Andorra Guides

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia